Rajul Mittal

Head of Sustainable Finance and ESG ,

Consulting

In a responsible investment universe, many investors focus on how to engage with individual investee companies to enhance their ESG performances. Through direct dialogues and proxy voting, responsible investors can potentially move investee companies to more sustainable operations & practices. These actions are called “active ownership”, which has been adapted gradually by most responsible investors when investing in equities directly.

In the bond market, there is an increased attention on special financial instruments which allocate capital directly to projects that can produce positive impact such as Green, Social and Sustainability Bonds.

Despite the hit from the pandemic, green bond issuance has seen unprecedented growth in the last couple of years. Expectation is that it can hit the one trillion issuance mark by 2023-24.

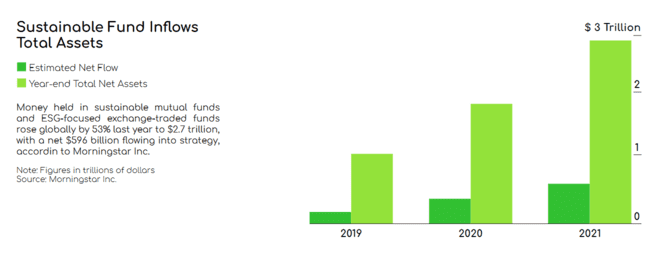

There is strong belief in the market that more and more financial instruments will gradually have an ESG connotation or wrapper, which is already the case with equities and bonds. This leaves us with funds, where a lot of literature is not currently available in terms of how to gauge funds considering ESG! The net inflow into sustainable funds has seen unprecedented growth in recent times particularly since the onset of the corona pandemic. In 2021 the inflow breached the 500M USD mark for the first time ever and the overall net asset for sustainable funds stands close to 3T USD.

Traditionally, an investment fund is a collective pool of money for specific investment purpose. An investment fund is normally managed by a professional fund manager based on certain agreed criteria. According to MSCI, by the end of 2020, the global coverage of funds consists of 192,000 fund share classes. Among all types of fund portfolios, the majority comprises of equities, bonds, funds (fund of funds) and other asset types.

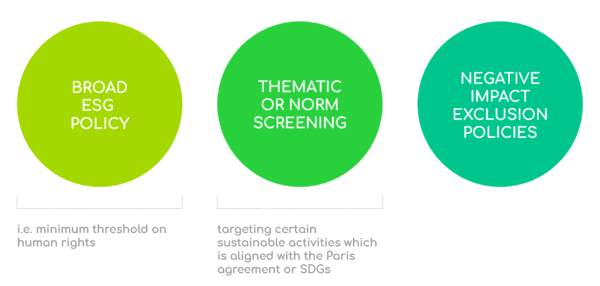

ESG funds are professionally managed with agreed investment process and strategies. Environmental, Social, and Governance factors are supposedly integrated in an ESG fund. An ESG fund in a broader sense can mean it has one or more of the following characteristics:

Demand for ESG funds is growing at an unprecedented rate. More than 250 new sustainable funds were launched in Q4, 2021. The market is also seeing increased activity in terms of repurposing existing funds into sustainable funds. Despite the rapid growth, currently in the global fund universe ESG funds only make up 5% of the total volume. Within the ESG funds the two main categories are ESG mutual funds and ESG ETF. Expectation is that ESG funds would continue to grow at a phenomenal rate in the current decade.

ESG investors can evaluate equities or vanilla bonds’ sustainability performance by reviewing ESG ratings of the issuers at company level. Traditional ESG rating agencies such as Sustainalytics, MSCI, Refinitiv and ISS provide corporate ESG ratings to give a taste of how a company is dealing with various ESG topics and associated disclosure levels.

At the same time, responsible investors are starting to ask what the real impact is from their investments. A more thematic approach is taken by investing in specific issuers such as electric car manufacturers or sustainable energy projects e.g., wind energy etc. Investors can invest through Green/Social/Sustainability bonds to make sure the profit and positive impact go hand-in-hand.

To evaluate how much impact is derived from these thematic bonds, investors usually review the projects at the onset and the potential positive impact is tracked on a yearly basis. Some common reporting indicators include carbon emission avoided, renewable energy generated, number of beds

in hospital created etc., depending on the underlying project.

As an ESG fund can be a combination of various asset classes (primarily equities, funds, and bonds), the pertinent question then becomes how to measure ESG funds’ performance?

Not surprisingly, the front runners of ESG rating markets, Morningstar (Sustainalytics), MSCI, Refinitiv, and ISS have jumped or are in the process of jumping onto this bandwagon i.e., ESG ratings/scores for funds.

Rating agencies calculate the weighted average rating based on fund’s underlying holding in respective companies & associated ESG ratings. Issuers where the ESG rating is missing are not considered for the calculation. Specific eligibility criteria such as minimum number of securities, minimum coverage rate of corporate ESG ratings, and exclusion of short position holding are applied in the calculations.

Some data providers consider the trend of individual ESG rating performance to anchor the fund rating and provide a more stable result. Some providers transform the rating into an adjusted rating scale to

give comparability within the same peer group. Besides the ESG rating weighted average approach, some ratings also provide extra ESG metrics to align investors’ interests with investment policies, global initiative, and even sustainable finance regulations. These metrics include but are not limited to carbon footprint intensities, green revenue, SDG impacts, and so forth.

However, these ratings only provide an aggregated view of corporate ESG ratings but not impact performance. For example, funds with higher ratings only imply portfolio securities issuers have better management of ESG issues but the rating doesn’t guarantee higher additional positive impact derived by the ESG funds. Therefore, funds with high ESG ratings do not guarantee the fund is greener (fossil fuel companies can have high ESG ratings and be included in the funds’ compositions). Some data providers make extra ESG metrics available to satisfy investors’ needs for impact me surement and reporting purposes. Noteworthy is that ESG data in most cases is incompatible across different rating agencies including unharmonized impact measurement indicators.

Furthermore, even though most ESG fund ratings are updated monthly to reflect the changes of holdings, the basis of the fund ratings is based on traditional corporate ESG ratings, which is updated only once or twice a year (aligned with company annual reporting cycle). It is quite challenging for a fund manager to know in time how a controversy at a given company (which is a constituent in the fund directly or indirectly) can adversely impact the ESG rating of the fund.

Greenwashing risk

Funds with high ESG ratings may give the impression that they generate higher sustainable impact compared to other funds, but that might not be the case. Particularly, fossil fuel companies with good management or timely disclosure of ESG issues can get high ESG ratings. To avoid green washing risk and to reduce potential reputation damage, the suggestion would be for ESG fund managers to further investigate majority of investee companies’ business activities and disclose the selection criteria.

Enhanced requirements from regulators

There is an increased scrutiny and attention since the onset of Sustainable Finance Disclosure Regulation (SFDR) in March 2021. Fund managers must assure the selection and management process are in line with the company’s sustainable investment policy and ESG factors are duly considered. To adapt to the upcoming Sustainable Finance regulations, compliance would become more stringent. Fund managers need to have an agile approach and flexibility in terms of data architecture to comply with reporting & regulatory requirements.

Sub-optimal quality of ESG data

Even though ESG led investments are growing rapidly, the maturity curve of ESG data is lagging and a lot of harmonization needs to be done. ESG data is very critical for investors to evaluate the investment result and must be comparable across different companies. However, even the scope 1,2 and 3 carbon emission calculation vary across various sectors and companies. Not all the companies have the capacity or capability to undertake such a calculation. The lack of complete and comparable data increases the difficulty for fund managers to estimate & report impact per ESG fund.

Lack of engagement power or direct conversation with companies

Typically, fund managers invest in multiple securities, which means that each fund only holds small fractions of many issuers’ shares or bonds. This characteristic leaves the fund manager with little negotiation power over the investee companies. The typical active ownership approach in responsible investment is therefore hardly applied in funds. As fund managers have little control over the portfolio companies, fund managers can choose either to disinvest in less sustainable companies or work together with other fund managers to engage with portfolio companies. This challenge is further compounded when we consider that most of the funds in turn are fund of funds and ownership is very distributed.

Fund managers are lacking a comprehensive understanding of detailed ESG issues

Depending on the sectors and regions, each company experiences a different set of material ESG issues. It’s almost impossible for a fund manager to understand key ESG issues of each investee company, yet an isolated controversial event in an investee company can drag down the overall ESG fund performance and can cause potential reputation damage. Until the time a comprehensive market standard evolves, fund managers need to be inventive yet diligent in the way they approach ESG funds.

Regulatory compliance considering SDF, EU taxonomy, PAI finance regulations on the horizon

Given the fund composition is not as straight forward as equities (where you can attribute sustainability factors to the underlying company), this makes it quite challenging to gather, analyse and report with respect to fund sustainability. A concrete example being how to match client preference as per MiFID II (product category a, b, c) with sustainability data points available at the fund level.

There is a definite view in the market when it comes to comparing equities in terms of ESG performance, the key guiding force being the relative position of a given equity within the respective sector. One can never compare a company like APPLE to SHELL, for example, in terms of any sustainability parameter but instead fall back on sector based relative positioning of individual equities. Funds ESG data still lacks the level of maturity compared to equities, additionally there is a lack of consensus or even opinion how to compare funds in terms of ESG performance. Find here the first glimpse into three ways to look at fund ESG performance and how to consistently strive for a better ESG performance.

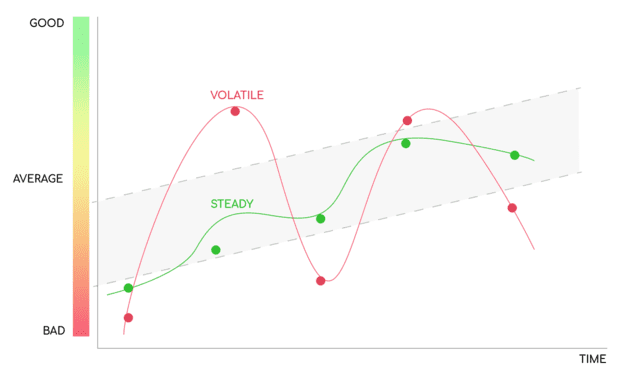

Graph 1. Evolution of ESG overall rating in a steady and stable manner. Only when fund objectives are changed a significant up-tick or down-tick in the ESG rating is to be expected.

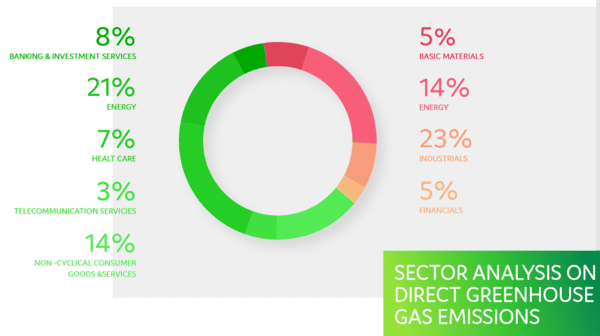

Graph 2. Sector analysis based on a given ESG metric (below using direct Greenhouse gas emissions):

The greener the category the more they outperform the sector average.

Graph 3. Divergence in fund.

Companies in an underlying fund having divergence in terms of either ESG Metric or performance. ESG metric can either be at level 1 (overall ESG rating) or level 2 parameters i.e., greenhouse gas emissions, biodiversity etc.

The growth of ESG funds will continue for the foreseeable future, given unprecedented interest both from institutional as well as individual investors. ESG Fund managers need to further build on their know-how in terms of how to integrate responsible investment in the governance and decision process. Along this journey the risk of greenwashing as well as reputational damage needs to be kept in mind and tackled.

It’s not necessary for an ESG fund manager to know everything about ESG, but ESG fund managers must know how to harness ESG data for informed decision making. Fund ESG ratings can be used as a proxy to evaluate the funds’ ESG performances, but it’s important to keep in mind that fund ESG ratings only tell one part of the story. ESG impact data and real time ESG events are normally not reflected in the rating. Fund managers should understand the limit of Fund ESG ratings and need to be inventive in their approach.

Authors

Rajul Mittal - Head of Sustainable Finance & ESG, Synechron

Gert-Jan Hoogendoorn - Head of Product, Objectway

Janet Chung - Managing Consultant, Sustainable Finance, Synechron