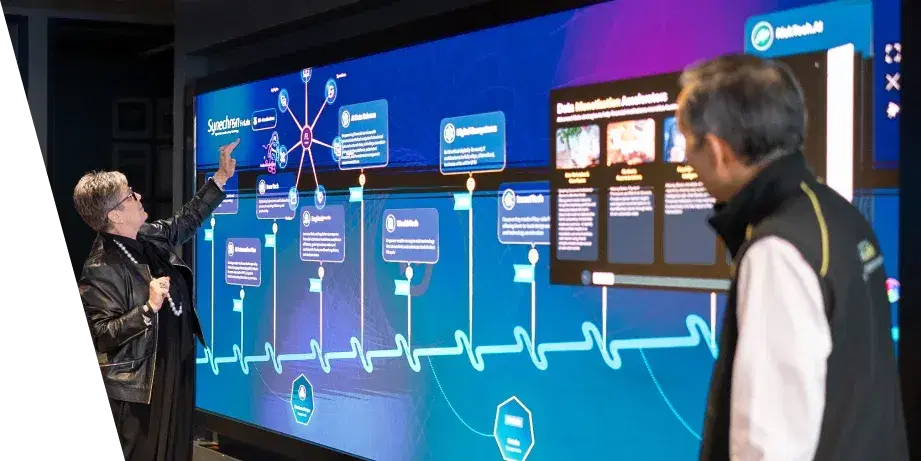

Client Lifecycle and Data First

Deliver change and efficiencies to your processes, leveraging your client data across the full lifecycle, from prospecting and onboarding to trading.

Client Prospecting

Our client prospecting solutions enhance a bank’s ability to perform prospecting by:

- Leveraging big data and analytics to automate the process of identifying high-value leads

- A single platform for all wealth management client onboarding, including tracked onboarding documents

- Applying AI and data science models to large volumes of demographic and consumer data to identify and prioritize high-net-worth individuals who have a greater likelihood of conversion.

Client Onboarding

Our account onboarding and Know Your Customer (KYC) solutions collect essential information for downstream compliance, anti-money laundering and fraud regulations. We deliver:

- Onboarding design and development expertise for clients

- A single platform for all wealth management client onboarding, including tracked onboarding documents

- Contextual navigation – clear segregation of fields based on onboarding journey context

- An AI-driven account opening chat interface to auto-complete onboarding forms

- Integrated data from marketing and client services systems.

Suitability

Wealth managers need to establish client suitability and determine whether an investment decision is in the best interest of the customer and complies with regulations.

Our efficient suitability solutions include:

- Utilizing current client profiles, securities characteristics, and internal wealth management rules to create a sophisticated ‘rules engine’

- Using data analytics to screen the viability of a client with respect to a bank’s product offering.

Multi-Account Opening

Open multiple accounts for numerous clients in the same account linked group. We deliver:

- Servicing of all wealth management clients, from mass affluent to high and ultra-high net-worth

- Strategic guidance, with new cutting-edge functionalities and interfaces.

Client Lifecycle and Data First

Deliver change and efficiencies to your processes, leveraging your client data across the full lifecycle, from prospecting and onboarding to trading.

Portfolio Management and Trading Processes

We can help consolidate multiple legacy trading mainframe systems, standardize data and services across multiple asset-classes, and migrate your advisors and your clients to more modern and resilient platforms.

Client Management and Ideation

Client Management and Ideation We offer modern business insights, digital tools and portals for advisors and clients, fueled by better ideation.

Client Insights

Our client insights include:

- Pricing – data analytics optimize client fee pricing across an organization, offering a top-line view of fees at the client level and benchmarking tolerances to attract and retain clients

- Asset tokenization – opens up new alternative investment opportunities for asset managers and their clients. We showcase asset management dashboards and illustrate how smart contracts work across a variety of scenarios

- Smart statements tech – gives clients and advisors access to highly customizable and interactive statement views with an integrated portfolio management toolkit.

Next Best Action

We offer tech-driven models for financial advisors that:

- Evaluate communications with clients by email, text and other means

- Apply machine learning to evaluate ideas that can then be suggested to clients.

Chatbots

Our chatbots can be used by financial advisors for annotating existing data sets and creating training data for NLP models to:

- Improve efficiencies and accuracy, and

- Enable financial advisors to locate the right information and documents fast.

Client Management and Ideation

Client Management and Ideation We offer modern business insights, digital tools and portals for advisors and clients, fueled by better ideation.

Regulatory Compliance and Change

Regulators expect wealth managers to demonstrate operational and cyber resilience and proactively engage with changing rules and expectations.

Empowering Innovation.

Accelerating Transformation.